Trade Forex with backtrader.com

With a turnover averaging $5 trillion a day, 5 days a week, money rarely sleeps. Trade 45 currency pairs with backtrader.com and enjoy lightning-fast execution from tier-1 liquidity providers.

What Are Forex Currency Pairs?

FCP

In the forex market, trading consists of the purchase or sale between two different currencies. These combinations of currencies are referred to as currency pairs. Exchange rates are the relative price of currency pairs when compared to each other. There are seven major currency pairs, all of which include the US dollar.

Trade long and short

Trade 24 hours 5 days per week

Mitigate currency risk

Carry trades

Everything a Successful Trader Needs

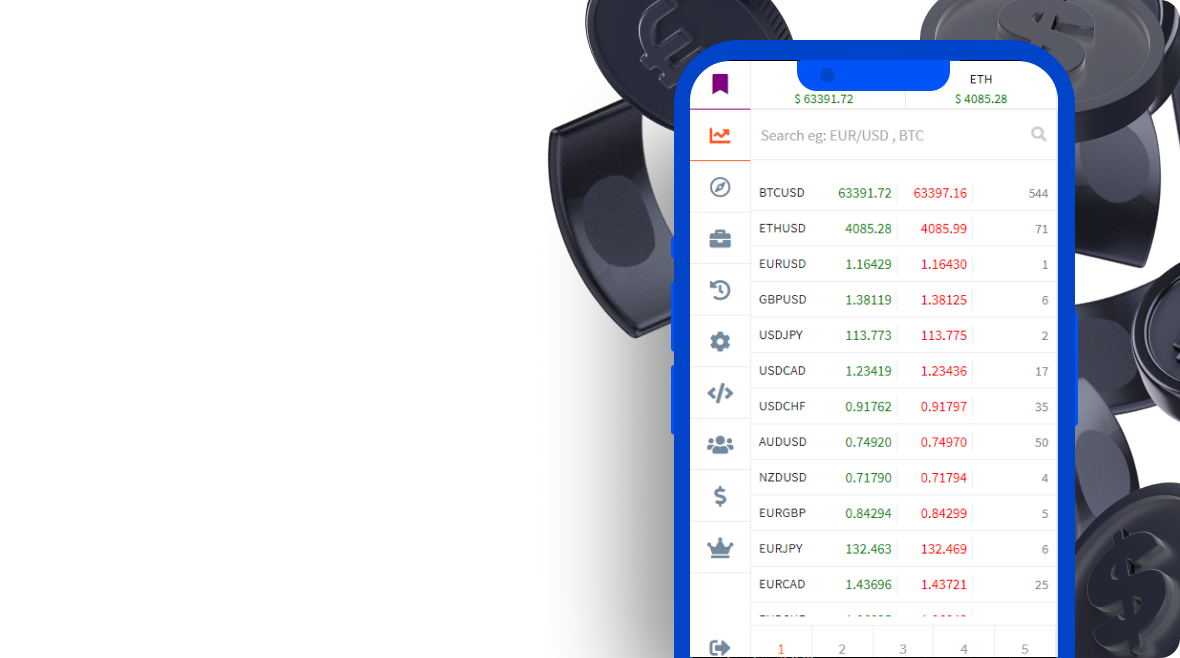

- Over 10,000 Trading Instruments

- Cutting-edge Trading Analytics

- Top Shelf Trading Environment

- Multiple Funding Methods

- Fully Regulated and Licensed

Why Trade with backtrader.com?

Multi-Asset Platform

Trade over 10,000 instruments covering stocks, crypto, forex, commodities and more

Top Shelf Trading Environment

Enjoy top-shelf trading conditions, with costs that beat 80% of our peers

Veteran Expertise

BlackTrader's team consists of trading veterans with a deep, first-hand understanding of markets

Experience-Driven Innovation

BlackTrader's product developers aren’t just technical experts – they're traders who’ve been in the trenches themselves

Advanced Trading Tools

Cutting-edge trading tools developed by an in-house team to drive the success of traders at all levels

Fully Regulated Brokerage

We’re licensed and fully compliant across multiple jurisdictions to ensure the highest levels of integrity

How to Get Started

Register

Verify

Fund

Trade

FAQ

What is a pip?

A pip stands for ‘percentage in points’ or ‘price in points’. This term was traditionally the smallest price increment of a currency pair; also, it measures the amount of change in the exchange rate for a currency pair, calculated using the last decimal point. For BlackTrader majors and minors excluding JPY, a pip is the 4th decimal point (0.0001). Meanwhile, on JPY pairs, a pip is the 2nd decimal point (0.01).

How to measure a currency spread?

The spread is the difference between the best bid and the best ask quotes of a currency pair, is measured in pips, and affects the cost of entering a trade. (Spread = Best Ask Price – Best Bid Price)

*The bid price is the price you can sell the base currency

*The ask price is the price to buy the base currency

*The base currency is shown on the left of the currency pair. Also, the variable, quote or counter currency, on the right.

How are forex CFD prices calculated?

Our CFD prices (Contracts for Difference) are derived from spot market prices. As CFDs are a derivative you are not trading physical currencies.

What are the most popular currency pairs?

EUR/USD is the most widely traded pair so it tends to have the tightest spread. But depending on the region and news flow, USD/JPY is also very popular with day traders, along with EUR/JPY and AUD/JPY.

What is tick volume?

The tick volume indicator looks very similar to a traditional volume indicator, only tick volume counts the number of bid/ask quotes per bar. Whereas a volume indicator from an exchange represents how many shares or contracts have been traded per bar.

How many forex currency pairs do you offer?

backtrader.com offers 45 currency pairs among many other products across commodities, metals, indices and cryptocurrencies. You can also enjoy lightning-fast execution from tier-1 liquidity providers.